Award-winning PDF software

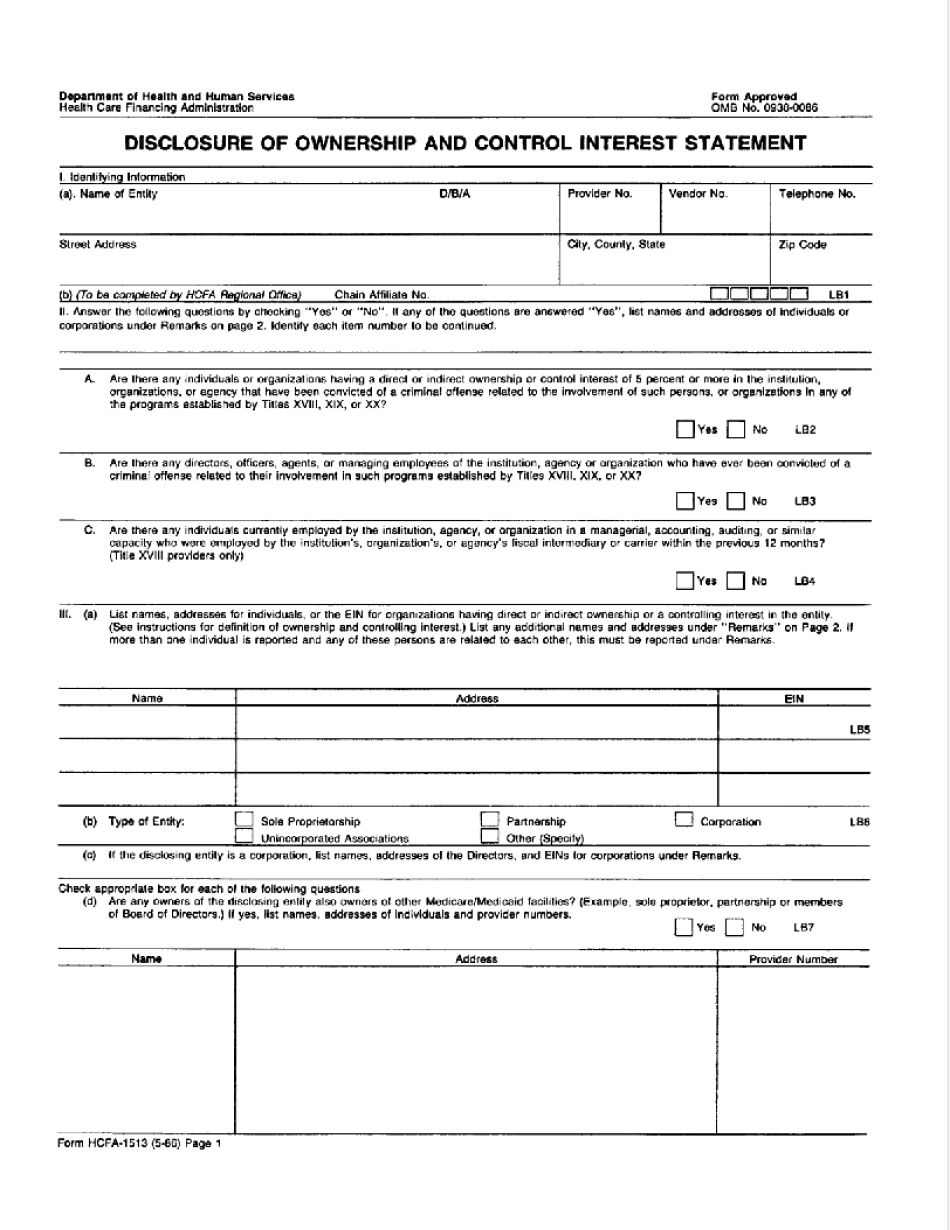

Disclosure of ownership & control interest bcbsil Form: What You Should Know

This form must be completed on behalf of the provider or disclosing entity. It must be completed in writing by the person signing for the provider, and is signed by all the person signing at the signing person's direction (or if the person signed in person and a witness was not present, by a notary public who will not have actual knowledge of the information that the disclosure forms are intended to provide, such as a person who acts as a witness in connection with an adverse decision or judgment). Providing the information on this form must be accompanied by a check or money order for 15.00 to an American Express, Discover Financial Services, or MasterCard debit/credit card or an equal amount in Canadian funds. HHS Publication 2072 — Employers' Contributions to Employee Health/Medical Coverage, includes requirements for the disclosure form. Illinois General Health Plan Disclosure Form This form should be used by the Provider who is paying for the medical/HIP plans for his/her personal employees. Illinois Government Insurance Disclosure Form This form must be completed and signed on behalf of the provider/disclosing entity and completed on behalf of the individual employer. State Employee Health Coverage Information & Services Disclosure Form This form is for employees reporting health insurances coverage on Form 1040EZ. There must be: a list of the employees' names and Social Security numbers, employer name, employment number and payroll filing number; a statement of the employer's policy or laws concerning employee insurance coverage requirements. Illinois Unemployment Insurance Disclosure This form must be completed and signed on behalf of the provider/disclosing entity and completed on behalf of the individual worker. Illinois State Plan Disclosure Form This form should be completed and signed on behalf of the provider/disclosing entity and completed on behalf of the employee. Illinois State Minimum Wage The Illinois Minimum Wage is listed on Form 1040NR for every state.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HCFa-1513, steer clear of blunders along with furnish it in a timely manner:

How to complete any HCFa-1513 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HCFa-1513 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HCFa-1513 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.