I would like to introduce Certified Elder Law Attorney Tim Crawford. He is a member of the National Academy of Elder Law Attorneys and is also a CPA. Tim has been assisting families with their planning needs for over 40 years. Let's hear what valuable information Tim will share with you today. Today, we are going to talk about Medicaid. Do I qualify for it? Medicaid is the federal program that pays for long-term care costs, including nursing home care costs, assisted living, and the cost of bringing somebody into your home. Now, do you qualify for that federal program? While that program is administered by your state and each state has slightly different rules, some rules are the same, and some rules are different. I practice law in Wisconsin, and we service the entire state of Wisconsin through a network of attorneys. We have three attorneys here in our office and twelve staff, and we service southeastern Wisconsin with multiple offices. Now, do you qualify for this program? Well, if you've always been low income and low assets, you probably will qualify. Now, what do we define as low income? Well, it's basically for the nursing home, having monthly income less than what it would cost you to be in the nursing home. So, most of my clients already qualify in that area. Now, to qualify for the government to help you with assisted living or to help you pay for bringing someone into your home to help you there, the income limits are significantly less, and they're complicated, and there are lots of rules. So, I would suggest you talk to a board-certified elder law attorney. They can help you with planning before you apply for benefits, and we always hope that you plan with us 5, 10, 15 years...

Award-winning PDF software

Medicaid program integrity Form: What You Should Know

There are three parts to the Program Integrity Unit, each related to one of Medicaid's programs: the Health Care Program, the Medical Assistance Program, and the Children's Health Insurance Program. The Unit's functions include: DHS — Nebraska.gov The Program Integrity Unit of the Nebraska Medicaid Office is responsible for the oversight of the Medicaid Program Integrity Program, which includes the following activities: Disclosure by Medicaid — Health Care Program — CFR § 135.300, Disclosure by Health Care Contractors.§ 135.401, State plan violation of program requirements. § 135,600 — State plan violations for Medicaid program integrity. § 135.601 — Prohibited acts by Medicaid providers.§ 135.603 — Adverse action, corrective or preventive measures, etc. In addition to the general Program Integrity Program duties, the Program Integrity Unit also develops and implements strategies for improving Medicaid program integrity.

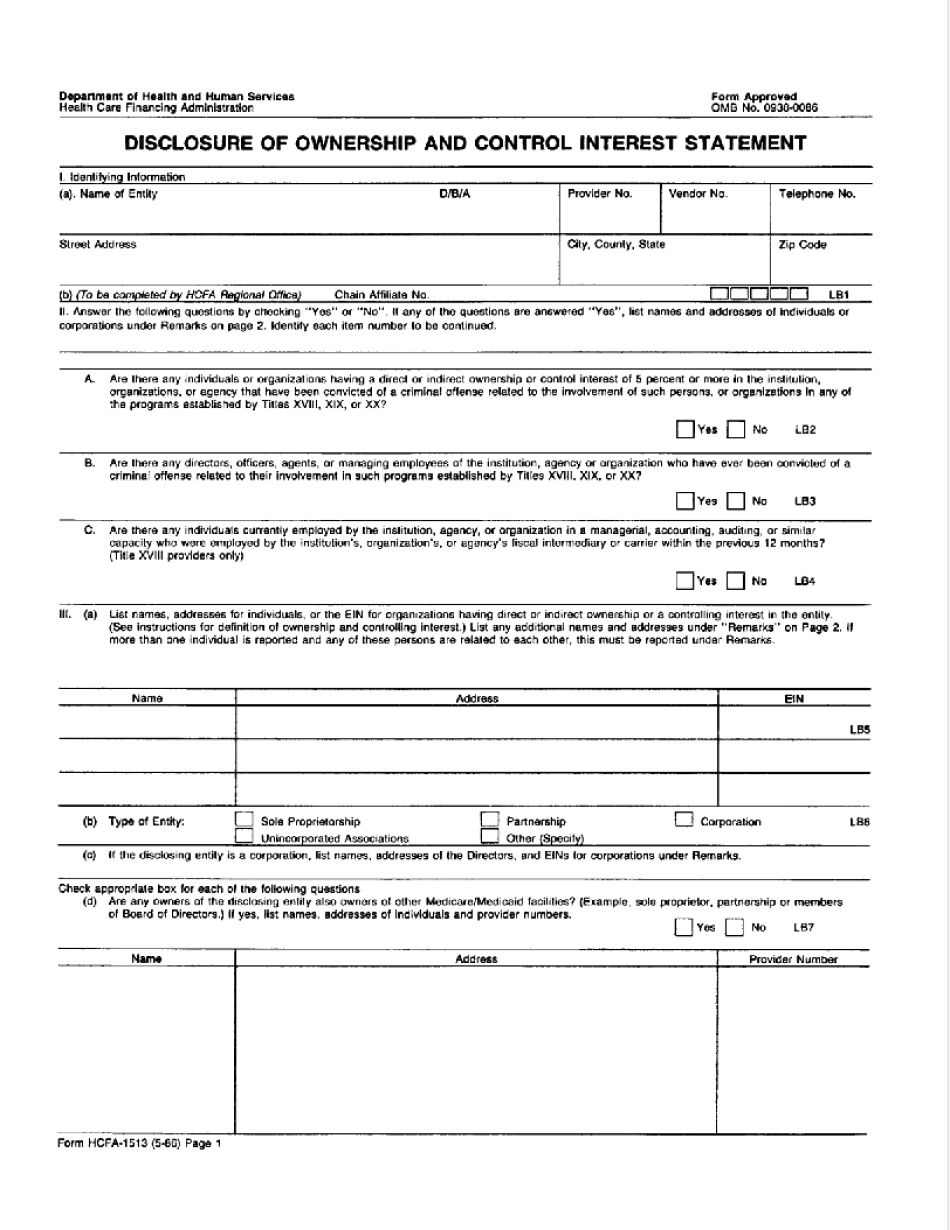

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HCFa-1513, steer clear of blunders along with furnish it in a timely manner:

How to complete any HCFa-1513 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HCFa-1513 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HCFa-1513 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Medicaid program integrity