Under the guise of a commitment to new forms of innovative job training, the Trump administration is going to hand literally hundreds of millions of dollars over to private businesses to conduct new forms of apprenticeships. - And of course, as with many of the other topics on today's show, it will be done without any oversight whatsoever. - So, this move is going to develop government-funded apprenticeship programs from the Labor Department. - Now those programs are being moved over to third-party private entities, including trade groups, labor unions (I'm surprised they actually put those in there), and private businesses as well. - The third parties are going to set their own bar for success with these programs and submit their metrics to the Labor Department for approval. - An approval private process that I predict will be rigorous. - Yeah, totally. I like that a lot. Again, how do you crack that code? Get approval? - Bad. I've got the zip. Just make sure you dot your T's and rasterizer record. This is still useful. - In fact, it's a larger use of government funds than previously. Yes, so that's the good sign theoretically. - And that's what they'll focus on, that they're actually doing more money. - So, Trump is going to redirect over 100 million dollars of federal job training money to pay for the new apprenticeships. - There will also be 90 million dollars in new funding for the existing program. - So, 2092, 200, with the basically the new hundred and ten. - Yeah, for the new pro. - So you hear that and you think, okay, there's some funding going to these apprenticeships and maybe we'll check back in a couple of years and it'll be great. - But you're taking money that was...

Award-winning PDF software

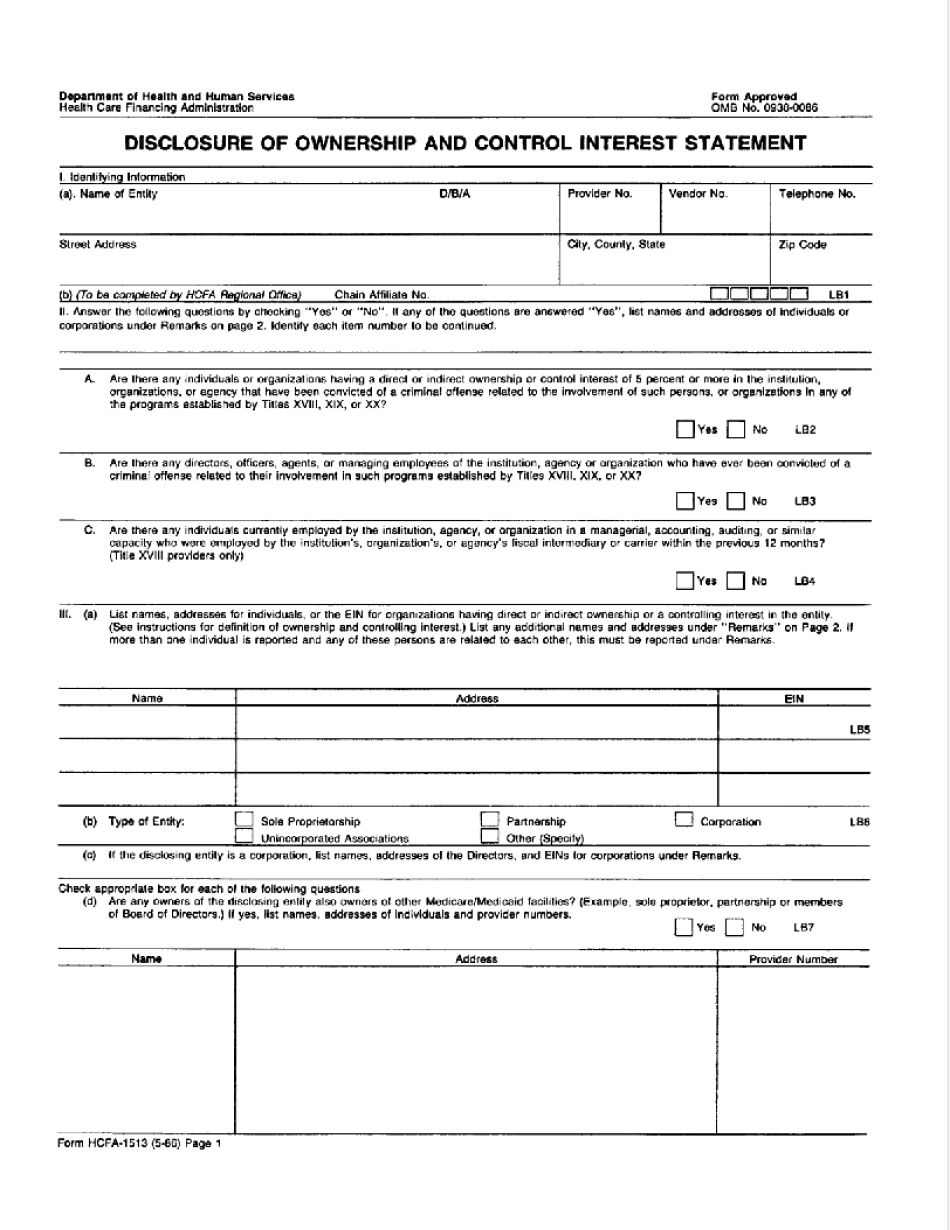

Federally required disclosures Form: What You Should Know

Information on any entity, including a health care provider. How to provide the Federally Required Disclosure Form (FDF) for Medicaid Providers and Fiscal Agents There are two information required for this process. First is the name of the person who provides the information and second is the address to which the information will be mailed. Name : Name and Address Address Address : The information that is used to complete this process: Name : Address : The first person who provides information for this process is the Medicaid provider, provider's fiscal agent, or other entity that has an ongoing relationship with the provider. This entity can be a health care provider, including a physician in a family practice medical group, or a health care provider who is not a physician. Name : State of Residence and City State of Residence : The information that identifies this Medicaid provider is what is used to verify: If applying from a state other than Alabama, it is the zip code of the principal business or the principal place of business. If using a zip code, it is the city of that zip code. If using an AL address, it is the county of such AD address. Name : An entity using the FDF has the option of including other personal information, such as their social security number, or credit reports. If applying from a state other than Alabama, it is the zip code of the principal business or the principal place of business. If using a zip code, it is the city of that zip code. If using an AL address, it is the county of such AD address. Aces Provider Information Name: Address : First, use the information on Aces. All information on Aces is protected under HIPAA. We provide additional information about provider and financial information that may be included in your FDF. You may want to use these additional details in your form. Name State Agency Name : The information that is used to validate the FDF information is what Aces do not provide. Name, Last Name, Social Security Number, Employer, Contact Email, Business/Place of Business, City of Location Any additional information that you choose to share for the FSA does not have to be included on the FDF.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HCFa-1513, steer clear of blunders along with furnish it in a timely manner:

How to complete any HCFa-1513 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HCFa-1513 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HCFa-1513 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Federally required disclosures form