Local pharmacy owner made more than two and a half million dollars off of medications between 2025 and 2025 well the problem is these are medications that he never provided to his customers abc2 news Katrina Bush found out how how we may have gotten away with it for so many years well be ready Vijay Anna petty has been convicted of healthcare fraud and identity theft the US Attorney says there's a significant amount of fraud associated with healthcare because there's just so much money running through the system it lasted for more than six years but now ready Vijay Anna Peretti is about to pay for the effects of his health care fraud scheme with his freedom he's been convicted of defrauding Medicaid and Medicare of more than two and a half million dollars US Attorney rod Rosenstein says with his access to patient and insurance information and a Peretti could fake the proper documents he was able to document his records as if the customer had actually come in an ordered medication but when investigators went in and examined his books that as they looked at the medications that he'd actually purchased at wholesale compared to what he claimed he'd sold at retail it didn't match up and Anna Peretti didn't act alone but with two pharmacy technicians originally from India he was sponsoring their work permits in the US the techs have pleaded guilty to making false statements about the scheme and are set for sentencing next month they worked at two of Anna peratis pharmacy store chains in Bel Air one was located at this plum tree Road Center the other on old Emerton Road has since been cleared out Rosenstein says anna Peretti repeatedly billed insurance companies for medications that customers never asked to...

Award-winning PDF software

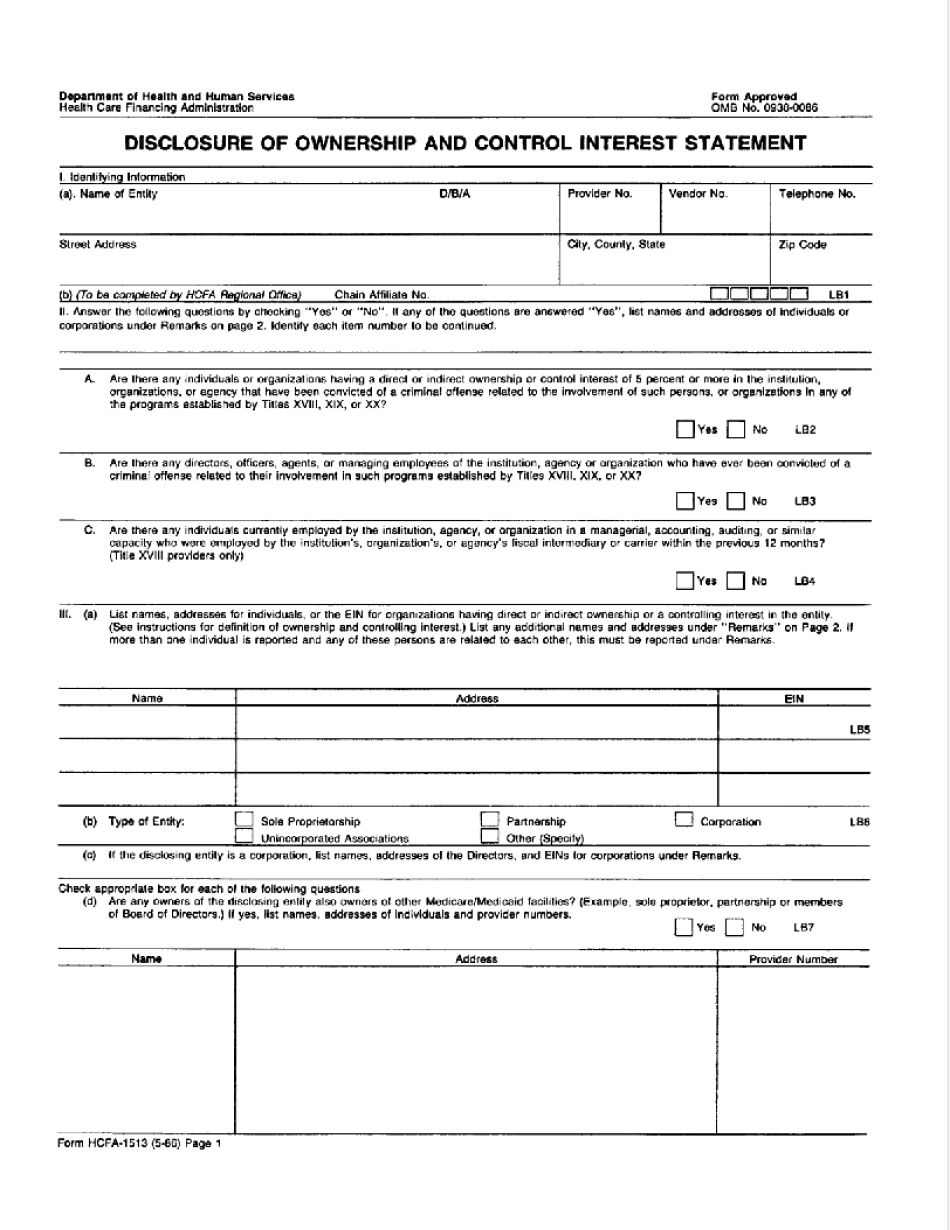

Medicaid change of ownership Form: What You Should Know

For a list of previous owners of your plan: A valid health account number of provider; A valid Health Care Identification Number of provider that has been assigned for you by Medicare or your local Medicaid Agency ; In addition to the above, a current Medicare-ID number. If a valid Medicare-ID does not have a photograph, you must provide an image or a certified photocopy of a current Medicare-ID that has a photograph. If you do not have a current Medicare-ID number, you must fill out the Change of Ownership in person with the Medicaid Agency in the office where this form was submitted for coverage. For information and an appointment, call the Medicaid Provider Enrollment Information Center (MEC) at or e-mail. For questions or more information on Medicaid and related services, contact the Arkansas Medicaid Agency, Division of Medicaid at or e-mail. For questions or more information on Medicaid and related services, contact the Arkansas Medicaid Agency, Division of Medicaid at or e-mail. To learn more visit If the previous owner's contract expires, they will take up to 5 months in which to close the enrollment. Before enrolling in Medicaid on or after September 30, 2018, you must pay the applicable monthly premium until all outstanding balances are paid. For questions about the applicable monthly premium, contact the Arkansas Health Information Services (THIS), Inc.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HCFa-1513, steer clear of blunders along with furnish it in a timely manner:

How to complete any HCFa-1513 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HCFa-1513 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HCFa-1513 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Medicaid change of ownership