Hello, hey, this is Sean. We're going to go over how to fill out a seller's disclosure statement. This is required whenever you put your house on the market, and it's something that the seller has to do. There shouldn't be any other tenants on this sheet except for the seller. Okay, the rule about disclosure is that if you are wondering whether or not you should disclose something, you need to disclose it. This is the number one reason people get sued in real estate because the seller either forgot about it or they just didn't want to put it on there because they thought it would affect the sale. Unfortunately, buyers have a way of finding out what happens, so maybe a neighbor might come over and say, "Hey, Mr. Buyer, did they tell you about that flood they had two years ago?" And then the can of worms comes up. Okay, so anyway, that's kind of the general rule. Now, filling this thing out is pretty self-explanatory, but there are a couple of tricky spots. General information, you know, when did you acquire it, the type of title. So normally, these days, the binder of the house or the abstract is registered with the city. So typically, if you do not have it in your physical possession, it will be registered at the city. Okay, and then, did you do title insurance when you bought the house? This is a one-time fee that you would have paid at closing. A lot of people do buy this. It's usually around four to six hundred bucks. You pay it at closing, so if you don't remember, you can put unknown and just answer the questions. Is it suitable for year-round use? Most homes are not manufactured, it would be like a...

Award-winning PDF software

Optum disclosure of ownership Form: What You Should Know

The Step 2: Filing an Unrelated Notice of Assessment with Financial Institution and (4) pay the miscellaneous domestic penalty. Step 2 of the Streamlined Domestic Offshore Procedures, the related Notice to Applicant, can be completed using the U.S. resident's account number or account number used in prior years of taxes. Step 3: Make an Unreported Filing Agreement. Make an Unreported Filing Agreement with one or more U.S. Taxpayer Identification Numbers (NIT) that are issued by the Internal Revenue Service (IRS). The Filing Agreement (Form 1040-ES) should be completed using your current account number unless you need to create an account number outside the United States for which you have a U.S. address. The Form 1040-ES is used to obtain an NIT and should be signed by the taxpayer with whom it is executed and by the taxpayer or other authorized person. Step 4: Make a Payment to the Government of India. Make an annual contribution of 50% of the foreign income tax due to the Government of India. Step 4 of the Streamlined Domestic Offshore Procedures, the Unreported Filing Agreement, that is signed when completing a non-U.S. person's Form 1040-ES or Form 1040, may allow the taxpayer to avoid U.S. income taxes imposed by Indian law, Indian tax legislation, or Indian regulations. Step 5: Make a Payment to the IRS. The non-U.S. person who has executed the Form 1040-ES or Form 1040 should indicate that the agreement has been signed, and the amount of the payment or payments to be made to the IRS. The non-U.S. person should indicate any foreign country, territory or possession through which the taxpayer has transacted business. Once the non-U.S. person has indicated the country, the Form 1040-ES is signed, a Form 1040NR, a copy of which is attached to the Form 1040-ES, is mailed to the IRS and, if an Indian- or foreign-resident citizen, an NIT is issued from the IRS. If the agreement is completed in accordance with these instructions, the non-U.S. person pays the foreign tax. Unreported Filing Agreement: 2018 Step 5: Use the U.S. Domestic Information Exchange Agreement (IDEA). U.S. IDEA is a voluntary alternative to filing U.S.

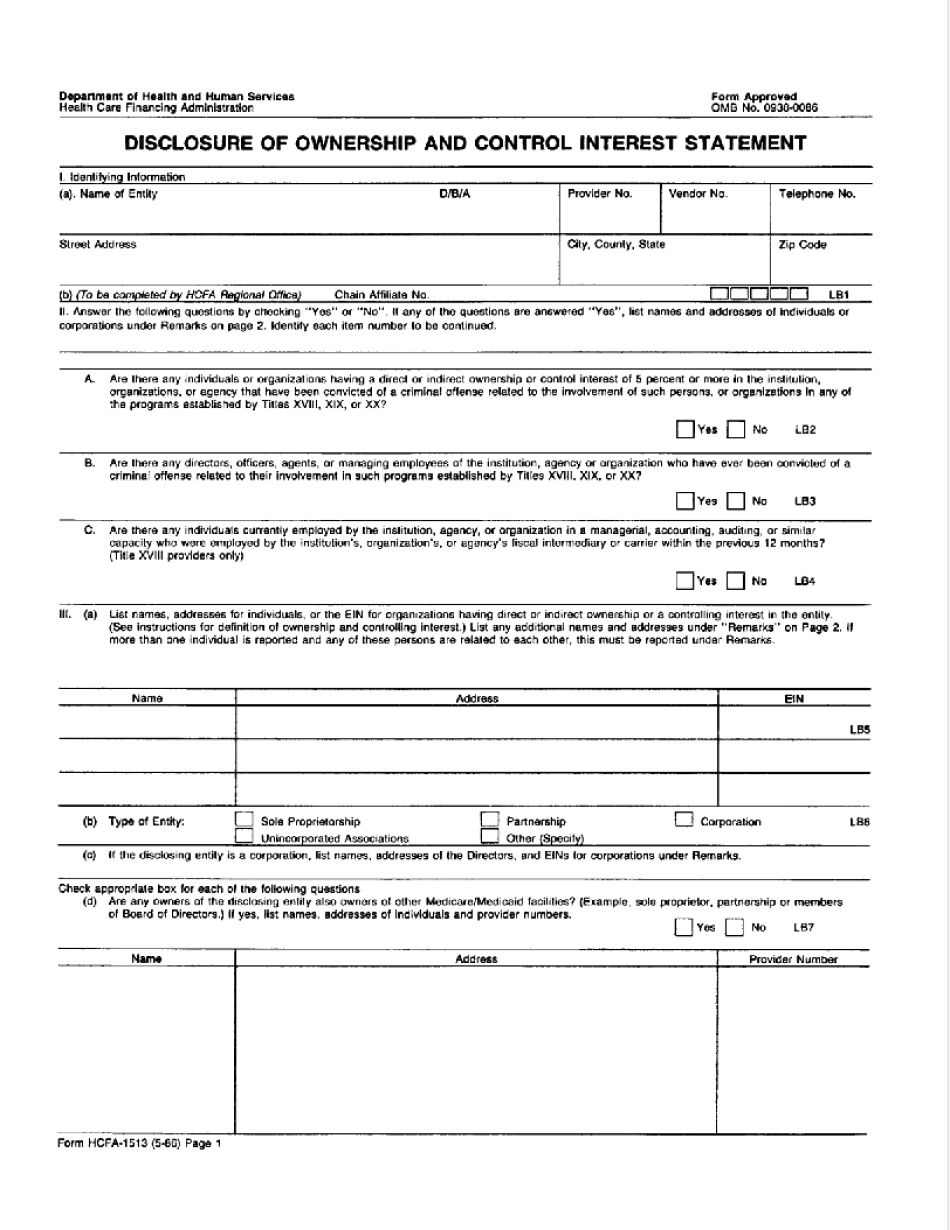

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HCFa-1513, steer clear of blunders along with furnish it in a timely manner:

How to complete any HCFa-1513 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HCFa-1513 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HCFa-1513 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Optum disclosure of ownership form