Hello, my name is Janice. Welcome to this video tutorial on how to renew your Medicaid d2 online. To start, click on the online option for renewing your Medicaid d2. If you already have an account, click "login" to access the login page. Enter your username and password and click "login." After logging in, you may get one of the following pages. Click on "Medicaid and tax credits" and continue until you land on the page to the right. Click on the "renew your Medicaid" link. If you don't have an account, click here to create one. Follow the on-screen instructions for creating a username and password. Once you are finished, click "create account" to complete your account creation. You must fill out your personal information here. Fill out the required information to move on. Click "continue" to complete this step. Click "continue" again to move on. Now that you have your username and password, go ahead and log in. After you log in, you are required to set your security questions. This will be used to verify your identity if you contact us. Once you reach this screen, click "find a submitted application or Medicaid renewal form d2." Complete the first name, last name, date of birth, and either your social security number or personal reference number on this page. Click the "next" button to move on. Once your case has been successfully linked to your my account, click "log out" to access your Medicaid renewal D2 online. Log back into your my account in DC health link. Click on the "renew your Medicaid" link on the renewing online page. Please select the appropriate option and click "Next." The information needed to complete your renewal page lists any information we were unable to verify. Click "Next." Verify the information on the summary page...

Award-winning PDF software

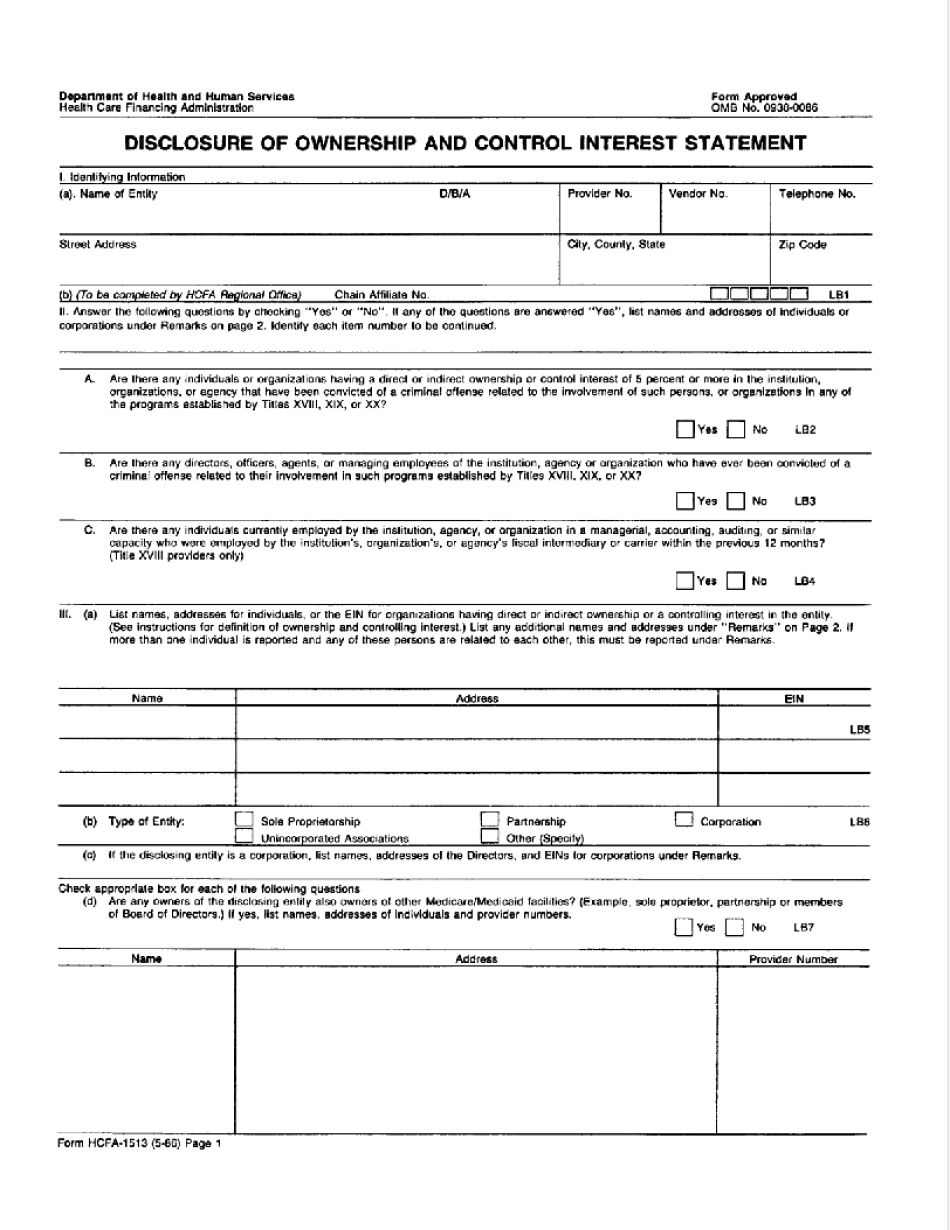

Medicaid disclosure of ownership Form: What You Should Know

In the case of a sole proprietor, the person or persons identified as that person in Form 20-F for the taxpayer should also be included with the taxpayer. Form 20-F If the owner is a corporation, the name of the corporation. If the owner is a partnership or an unincorporated organization (except a branch or local chapter), the name of the partnership or organization. Form 20-K If the principal place of operation is in the state, the name of the state. Form 20-M If the principal place of operation is outside the state, the name of the state. Other identifying information, including a financial statement, report for financial year that includes information from the 1st through 31st Other identifying information, including a credit report from a credit bureau, financial statement, report for financial year that includes the following information, and the credit report for the financial year containing information from the 1st through. 31st month, the entity must (b) the name, addresses, and tax identification number(s) of any person (man/woman or entity) other than the owner of the medical group or individual Name, addresses, and taxpayer identification Name, addresses, and taxpayer ID number; the taxpayer identification number is generally available with the Department of State. Other identifying information, including a copy of medical group or individual disclosure statement, medical bill, or similar record This information must be verified by the disclosing entity to be accurate. Name, addresses, and taxpayer identification Name, addresses, and taxpayer ID number, Name, addresses, and taxpayer identification The disclosure statement must include the disclosure information as it appeared on the date the disclosure statement was made. Tax return information: If a tax return is needed for purposes of verification, the tax return information must be verified with the financial statement, report for financial year that includes information from the 1st through 31st month, and Form 20-K or Schedule F of Form 1040, 1040A, 1040EZ, 1005, 5471, 5477, or other appropriate information Form 20-R This document MUST be completed and signed by the disclosing entity.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HCFa-1513, steer clear of blunders along with furnish it in a timely manner:

How to complete any HCFa-1513 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HCFa-1513 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HCFa-1513 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Medicaid disclosure of ownership form